Welcome to Lone Star Lawyers®!

We use law incorporating the use of our integrity, resources, knowledge, experience, networking and communication skills for our clients’ satisfaction through their vindication, maximization of profits and minimization of costs.

My law firm was established in 1990, and I believe in giving customers personal attention. I work to answer your business questions so that you can better understand your rights and options. I am your Houston Business Attorney, Disputes, Litigation, Contracts.

Practice Area

Business Dispute Resolution

The two most common alternative dispute resolution methods available are arbitration and mediation. Both methods can help you settle your conflict and save you significant

Contract Review

It is a common misconception that agreements are typically oral. If there arises a need to force compliance with an agreement, it’s important to know that certain agreements

Probate Law

Without an estate plan, state law dictates what happens to a person and their things when they no longer are able to. We can offer two types of simple and comprehensive

Collections Law

Collection of debt can be easy or complicated depending on the type and security of the debt. If a dispute arises, we can help ensure a seamless transition from

Commercial Real Estate Law

As a property owner, it's in your best interest to be well-represented in commercial real estate law. That's where Howard M. Kahn PC can help by walking you through your

Expert in Today’s Complex World

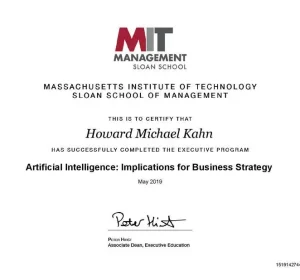

Are you stressed with a business problem in Houston? A Houston Business Attorney, Disputes, Litigation, Contracts, should be able to help. My name is Howard M. Kahn,

Latest News and Updates

What Our Clients Say

James Hesch

It was an honor to have Howard represent me and my company in a lawsuit. His expertise in law and high-energy vigor in pursuing the truth and keeping the case from stalling were impressive. I attribute the favorable resolution in great part to his knowledge, integrity and hard work. I would not hesitate to hire him again.

Ray Davis

I would highly recommend Howard to anyone. He is thorough, precise, detailed and very knowledgeable of the laws which we are governed by. If I was in need of legal representation, Howard would be the first one I would call.

Trey Yates

Howard is a tenacious trial attorney who fiercely advocates for the legal wellbeing of his clients. If I have a question regarding a business legal matter, Howard is the first attorney I call for advice. I have had no hesitation over the years in referring several of my family law clients to Mr. Kahn when they find themselves in a business dispute.

Jon Eliot King

Howard Kahn is one of the finest attorneys that you will find. He is attentive to his client's needs, provides timely and insightful legal advice, and is very proficient in obtaining top results that sometimes exceed his client's expectations. I would recommend Howard Kahn, the Lone Star Attorney, to anyone who is in need of timely and effective legal assistance as Howard is one of the best attorneys that you will find. Jon E. King: 713 255-5341.

David Cowan Executive Sales, Houston Oil & Energy

Mr. Kahn is an excellent attorney who keeps his clients informed and works diligently to attain the objective. I highly recommend Howard!

-David Cowan Executive Sales, Houston Oil & Energy